The story of the emergence of a political counterculture, initially in the late 1950s and given voice by the Liberals, and thereon spilling out into the voluntary sector and back again, has been a story of complete non-communication.

The political mainstream has their issues - they are usually about public spending and private ownership and little else - and the counterculture has theirs. There's little or no debate between them.

There are a few exceptions to this, I know. Roy Jenkins, as a reforming 1960s Home Secretary, managed to bring the two worlds together when he first legalised abortion and homosexuality. But it's a bit sad, generally speaking.

Try breaking into the general election debate with a new thought - as I have tried many times. It's a pretty thankless task.

One of the side-effects of this gulf is the rise of bizarre conspiracy theories - that the coalition is in the process of privatising the NHS, that the government wants to gag charities from public debate, that international bankers killed John F. Kennedy to prevent him changing the way they create money. You know the kind of thing.

It isn't really surprising given that one side talks about one set of issues and the other doesn't.

But I wondered today if the dam was showing signs of bursting.

First, there was Vince Cable going out of his way to address the concerns of trade campaigners about TTIP, calling for a great deal more transparency, and extracting a letter from the European Commission that confirms that the NHS will not be subject to its terms.

It is a brave move and it won't make him popular in the establishment. But of all the political gestures that claim to be leaping the chasm with the disaffected, this is about the only one that might do anything along those lines. It is one of those days that I feel quite proud of my own party.

Second, there was the Guardian's coverage of the Green Party's proposal for a citizens income. Nothing along those lines has been allowed in mainstream political coverage before. It wasn't exactly praising the idea - quite the reverse - but it opened a chink in the Great Wall between government and governed.

Personally, I am keener on the idea of a citizen's income, which seems to me to be a ferociously Liberal way of getting bureaucrats off our back and setting ordinary people free. The research the Guardian cites demonstrates that it would be next to impossible to organise this through the tax system.

The original idea of a citizens income was that it would become the new way that money was released into the economy. The banks would be prevented from creating money, as they do now, and it would be given to citizens instead to trickle up, rather than trickle down. A fundamental reform.

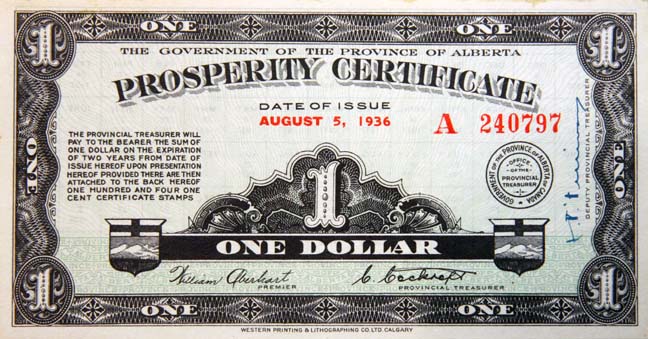

This was the platform of the Social Credit party when they took control of Alberta in 1943, only to have their citizens income ruled unconstitutional (they still stayed in power for nearly three decades).

The question I want to ask is this. Is there a middle way that allows the state to create money for a citizens income, and to prevent inflation by clawing some of it back through sales taxes, and by controlling - though not necessarily outlawing - some money creation by banks.

Our political debate is still so narrow that no other means of making things happen, apart from the failed business of tax and spend, ever gets considered. But today the dam cracked a little - just a little. And I'm excited about that.

Subscribe to this blog on email; send me a message with the word blogsubscribe to dcboyle@gmail.com. When you want to stop, you can email me the word unsubscribe.

2 comments:

It's possible that a citizens income could result in a half-way house anyway: intermediaries (eg banks) may scoop up liquidity and start to lend it. The process could be similar to the way post-Soviet privatisation in early 90s Russia, based around the idea of handing out shares in public assets to all, soon led to oligarchs.

But also, read Eric Lonergan's recent and hopeful Foreign Affairs piece on how quantitive easing could be much improved if directed differently.

Another voice saying QE for the banks would be better spent as a dividend for the citizens is Prof Steve Keen at Kingston-on-Thames University

see http://www.debtdeflation.com/blogs/

Post a Comment